A panel of four McGill professors debated the merits of fossil fuel divestment at an event organized by Divest McGill on March 15. While the topic remains contentious at McGill, 133 educational institutions worldwide have already divested their endowments from the fossil fuel industry, including Laval University, the only Canadian institution to do so.

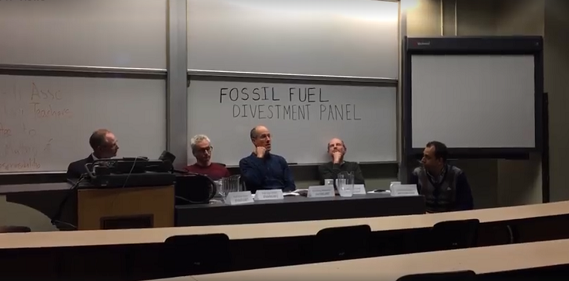

On the panel was Greg Mikkelson, associate professor in the School of Environment; Dror Etzion, associate member of the School of Environment; Ken Hastings, molecular biologist and Vice-President Finance of the McGill Association of University Teachers (MAUT); and Christopher Ragan, the newly-appointed director of the Max Bell School of Public Policy. The panel presented contrasting ideas about the merits and drawbacks of universities divesting from fossil fuel companies.

Mikkelson began the debate by citing research showing the impact that divestment campaigns can have in creating social change. Examples of successful divestment campaigns include the international boycott of South African goods during apartheid, and a global movement to divest from major tobacco companies in the 1990s.

“The research shows that [divestment] does make a difference,” Mikkelson said. “The most comprehensive study [of divestment movements] was done at Oxford, and they looked at other divestment campaigns that didn’t necessarily cripple the industries they were targeting, but what they did do is make a big public impact, and that spurred governments to take action [….] Divestment creates impact by raising awareness, stigmatizing target companies, and influencing legislation.”

Etzion further emphasized the status of divestment as a social rather than economic movement.

“I don’t really perceive [fossil fuel divestment] as a financial tactic,” Etzion said. “It’s about something much bigger than what you invest in, it’s actually a social movement. And the objective of this tactic is to de-legitimize an entire industry. [Universities] are very influential in how the world perceives issues, and [divestment] empowers people to envision a world that is not running on a path to destruction.”

Hastings gave the faculty perspective by describing the discussion that took place at the MAUT Fall General Meeting on Nov. 17, in which the association voted to divest its funds from fossil fuels.

“Some people felt that the idea of divesting is grandstanding, that it wasn’t really doing anything concrete,” Hastings said. “There were quite a few people more in favour of positive actions, like supporting alternative energy in some positive way, rather than pulling out [of fossil fuel]. Nonetheless, the motion passed by wide margins.”

Ragan, chair of Canada’s Ecofiscal Commision, took a stance against divestment, expressing doubts about McGill’s ability to tangibly impact fuel emissions. He instead suggested alternative policies.

“The reason that divestment doesn’t actually reduce emissions is that it is trying to get at the supply of oil,” Ragan said. “Policies that are effective have to be policies that try to reduce our demand for oil. A carbon tax or a cap and trade system is aimed right at that. Regulations of various kinds are aimed at that. So let’s talk about those policies, that Canada is now doing and ought to be doing way more of.”

Audience members were also given the chance to share their opinions. Several proposed shareholder action, wherein parties retain shares of firms with the intention of influencing their behaviour, as a potential alternative to divestment. Antonina Scheer, U3 Arts and the organizer of the event, commented on the potential for this method to reduce emissions.

“As a shareholder you can say OK, let’s change what we’re doing, but overall the company is fine and we can just tweak things,” Scheer said. “In the case of fossil fuels, we have to phase it out and we have to phase it out really quickly. So as a shareholder, you’re asking them to shut down the company, which is not something a shareholder can do.”